All Categories

Featured

Table of Contents

Guaranteed global life, like entire life, does not run out as long as you acquire a plan that covers the rest of your life (funeral insurance nyc). You can buy a policy that will certainly cover you to age 121 for maximum defense, or to age 100, or to a younger age if you're attempting to conserve money and do not need insurance coverage after, say, age 90

Anything. An insured may have intended that it be made use of to pay for points like a funeral service, blossoms, clinical bills, or assisted living facility prices. The cash will certainly belong to the beneficiary, that can decide to utilize it for something else, such as debt card financial obligation or a nest egg.

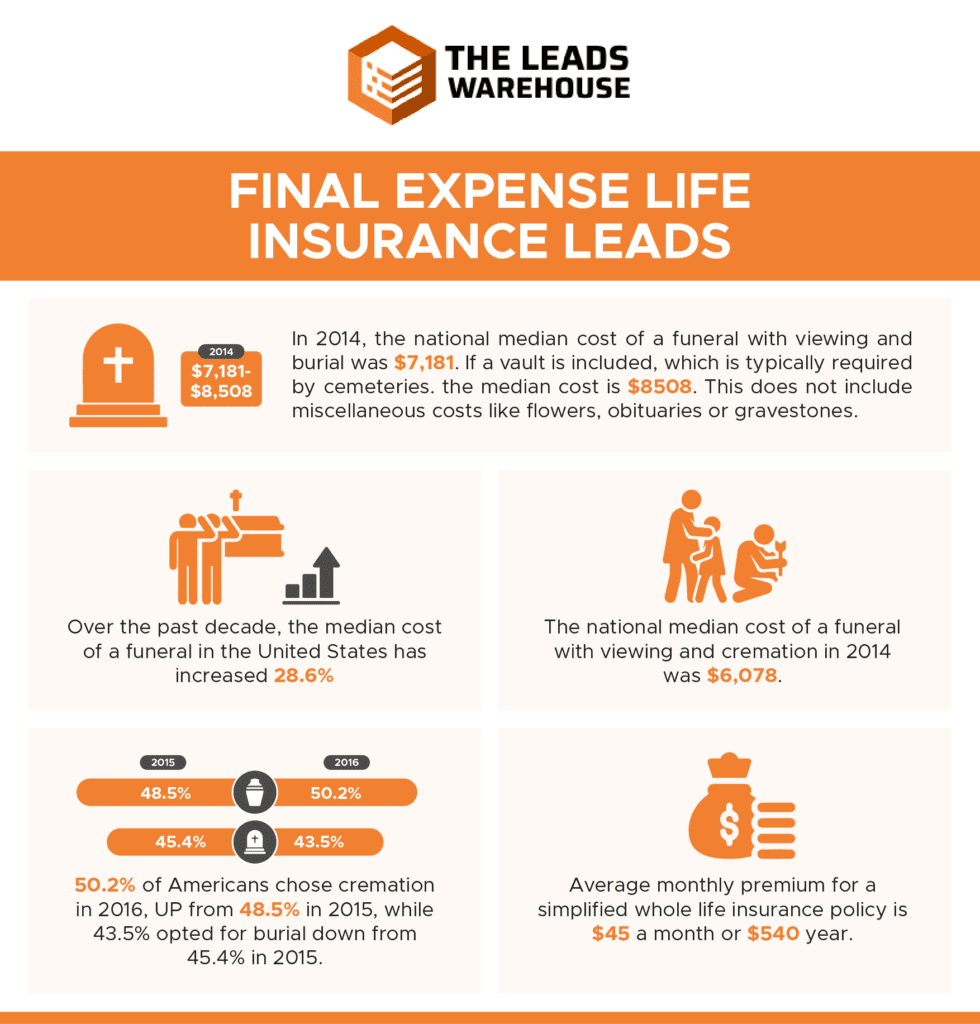

The majority of sites using it have calculators that can provide you an idea of price. For illustratory objectives, a 65 year-old woman looking for a $10,000 face amount and no waiting period might pay concerning $41 each month. For an ensured acceptance plan, they 'd pay $51. A 65 year-old male looking for a $10,000 face amount and no waiting period may pay about $54 monthly, and $66 for ensured approval. funeral insurance for over 80.

Burial Insurance Ny

If you have enough money set apart to cover the expenditures that must be satisfied after you pass away, then you do not require it. If you do not have money for these and other connected expenses, or routine insurance policy that might cover assist them, last expenditure insurance policy might be a genuine advantage to your family members.

It can be utilized to spend for the different, typical solutions they desire to have, such as a funeral or funeral. Financial expense insurance is easy to get and economical - insurance to cover funeral costs. Insurance coverage amounts range from $2,000 as much as $35,000. It isn't a significant quantity however the advantage can be a blessing for relative without the monetary wherewithal to satisfy the expenditures related to your death.

While several life insurance products require a clinical exam, final expense insurance does not. When applying for final expenditure insurance coverage, all you have to do is address several concerns concerning your health and wellness.

How Does Funeral Insurance Work

If you're older and not in the best wellness, you might notice greater premiums for final expenditure insurance - gerber burial insurance. Prior to you commit to a last expense insurance policy, think about these variables: Are you simply looking to cover your funeral service and burial expenses? If so, last expense insurance is likely an excellent fit.

If you 'd like enough protection without damaging the financial institution, last cost insurance policy might be worthwhile. If you're not in fantastic health and wellness, you may want to avoid the clinical exam to get life insurance protection. In this case, it may be clever to consider final expense insurance. Last cost insurance can be an excellent method to assist secure your liked ones with a tiny payment upon your fatality.

Last costs are the expenses your family members pays for your burial or cremation, and for various other points you could desire at that time, like a gathering to celebrate your life. Assuming about last expenses can be hard, knowing what they cost and making sure you have a life insurance policy - best burial plans huge enough to cover them can assist spare your family members a cost they may not have the ability to afford

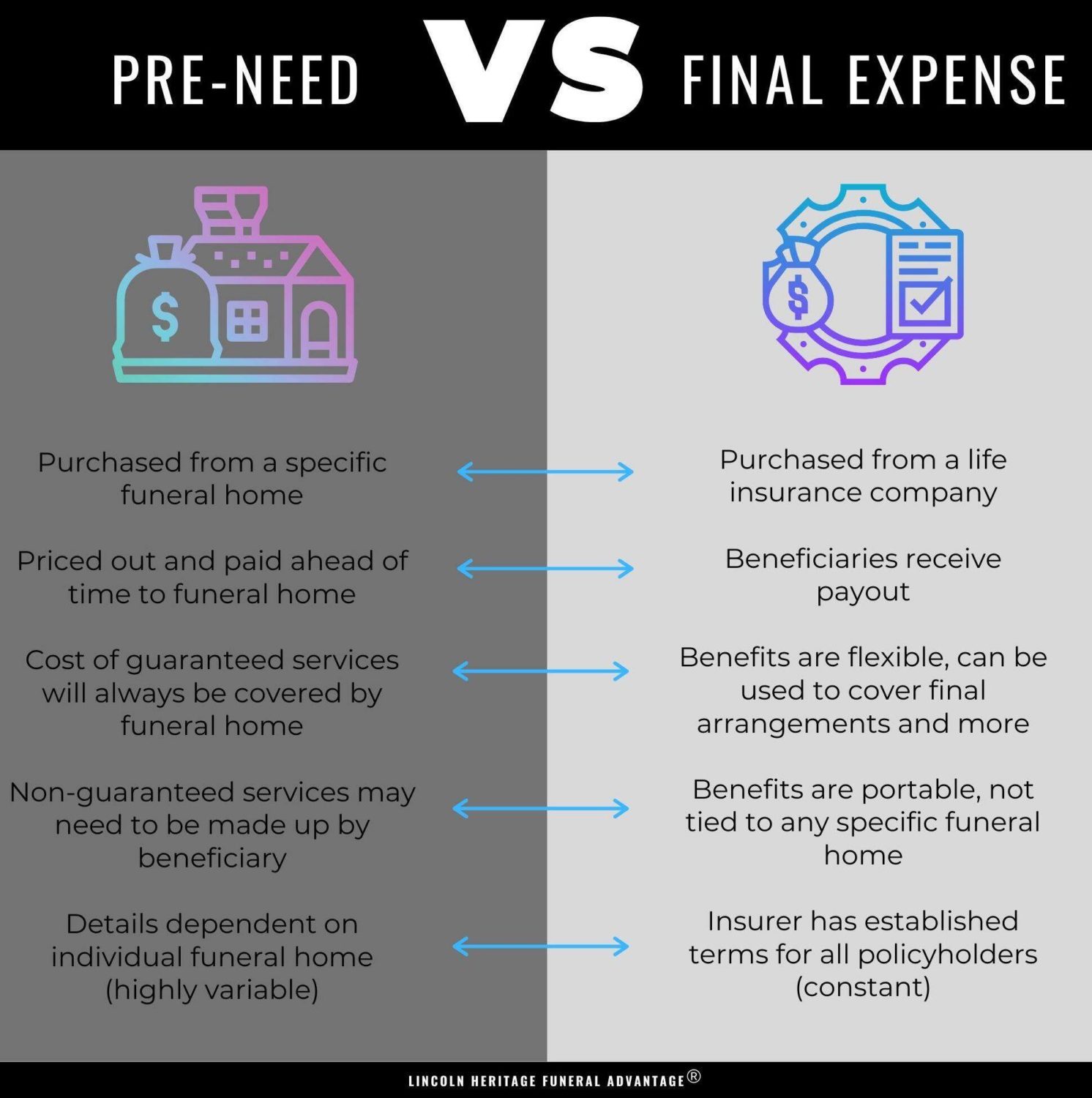

One alternative is Funeral service Preplanning Insurance which permits you pick funeral products and solutions, and money them with the acquisition of an insurance coverage. Another option is Final Cost Insurance Coverage. This kind of insurance policy gives funds straight to your beneficiary to assist spend for funeral and other costs. The amount of your last expenses depends upon numerous points, consisting of where you reside in the USA and what kind of final plans you want.

How Much Is Funeral Insurance

It is predicted that in 2023, 34.5 percent of family members will certainly pick funeral and a higher portion of family members, 60.5 percent, will certainly pick cremation1 (top rated final expense insurance companies). It's approximated that by 2045 81.4 percent of families will select cremation2. One reason cremation is becoming a lot more preferred is that can be much less costly than funeral

Relying on what your or your family members want, points like funeral stories, serious markers or headstones, and coffins can boost the price. There might also be expenses in addition to the ones particularly for interment or cremation. They may include: Covering the cost of travel for family and liked ones so they can go to a service Catered meals and various other expenses for a party of your life after the solution Purchase of special attire for the solution When you have an excellent idea what your final expenditures will certainly be, you can help prepare for them with the appropriate insurance plan.

They are typically released to candidates with one or even more health and wellness conditions or if the applicant is taking particular prescriptions. sell final expense over the phone. If the insured passes during this period, the beneficiary will usually obtain all of the costs paid right into the plan plus a little added percent. One more final expenditure alternative supplied by some life insurance policy firms are 10-year or 20-year plans that give applicants the choice of paying their policy in full within a particular amount of time

Senior Burial Insurance

One of the most essential point you can do is address questions honestly when getting end-of-life insurance. Anything you keep or hide can cause your benefit to be refuted when your family members requires it most (senior citizens funeral insurance). Some individuals think that due to the fact that a lot of final expense plans don't need a medical examination they can exist regarding their wellness and the insurance business will never understand

Share your last desires with them too (what blossoms you might want, what passages you desire checked out, tracks you want played, etc). Documenting these beforehand will certainly conserve your enjoyed ones a lot of stress and anxiety and will stop them from trying to presume what you desired. Funeral prices are climbing regularly and your health and wellness can transform instantly as you obtain older.

It is essential to review your coverage commonly to ensure you have sufficient to secure enduring relative. The key recipient obtains 100% of the fatality benefit when the insured dies. If the key recipient passes before the insured, the contingent receives the advantage (final funeral insurance). Tertiary beneficiaries are frequently a last resource and are just made use of when the key and contingent beneficiaries pass before the insured.

Family Funeral Policy

It's essential to occasionally assess your recipient details to make sure it's current. Always inform your life insurance firm of any kind of modification of address or phone number so they can update their documents.

The fatality benefit is paid to the primary beneficiary once the case is authorized. It depends upon the insurance provider. The majority of people can get coverage until they turn 85. There are some companies that insure somebody over the age of 85, yet be prepared to pay a really high premium.

If you do any kind of sort of funeral preparation beforehand, you can document your final yearn for your main beneficiary and demonstrate how much of the policy benefit you wish to go in the direction of final plans. selling funeral policies. The process is generally the exact same at every age. A lot of insurance provider call for an individual go to the very least one month old to make an application for life insurance policy

Some firms can take weeks or months to pay the plan advantage. Your insurance policy rate depends on your health and wellness, age, sex, and exactly how much coverage you're taking out.

Latest Posts

Best States To Sell Final Expense Over The Phone

Burial Insurance Policy Seniors

Burial Insurance For Terminally Ill